Run speciality store franchisor Fleet Feet has just released its inaugural Running Report. The data is a compilation of a survey commissioned with YouGov, scan data from technology partner Volumental, and systemwide sales data from Fleet Feet’s more than 270 locally owned and operated stores. Results detail general consumer interest as well as bestselling brands and products.

“Some of the data validates what we know about our customers and products, and supports what we see in our stores each and every day; while other data challenges us to think differently about how we can connect with new customers,” notes Joey Pointer, president and CEO of Fleet Feet. “We’re in a unique position to share trends about the running industry, and drive the conversation around the state of running now, and more importantly, where it’s headed.”

Fleet Feet Running Report Insights

Where is it headed? The report calls out ASICS, Karhu, and New Balance as the three fastest-growing shoe brands. Still, they’ll need to sprint to catch up with HOKA, which nabbed two of the top three running shoes sold at Fleet Feet. Lululemon, Vuori, and Rabbit were the top earning apparel brands, and Maurten and Nuun were the bestselling nutrition offerings.

“The past few years, we’ve seen an uptick in running interest and participation,” adds Tiffany Lee, senior director of performance marketing and partnerships at Fleet Feet. “Understanding our customers allows us to better serve them, and our hope is that tapping into these insights will allow us to inspire even more people in our communities to start moving.”

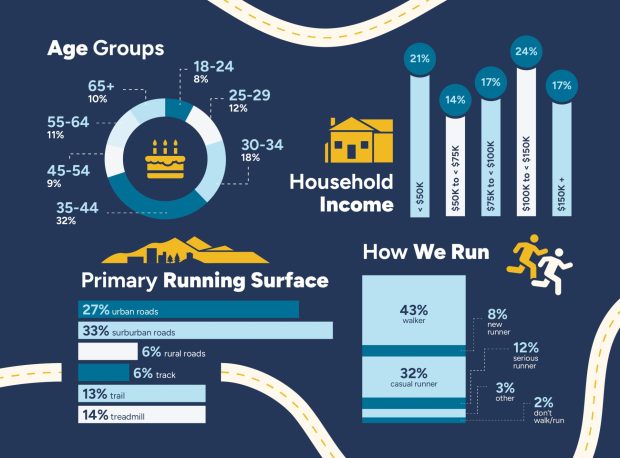

YouGov’s custom survey tapped 3,500 people aged 18 and older who spent $75 or more on running shoes and/or apparel and accessories in the past year. According to the results, more than 80% of respondents use running or walking as their primary source of exercise. Nearly half of respondents run two to four times a week, with a quarter running six to seven times a week. Fifty percent of runners and walkers are between the ages of 30 and 44.

The survey also delved into things like running surface (most run on urban or suburban roads) and average miles per week (17). In the sales breakdown, Fleet Feet revealed the top growing accessory category is nutrition, followed by insoles. The top five bestselling shoe models were dominated by HOKA and Brooks. Meanwhile, Volumental scan data offered some surprising insights.

Fleet Feet Volumental Scan Data

- 15 % of women and 19% of men have at least a half size of difference between feet.

- Nearly half of women and men have a high arch.

- Half of men have a wide foot.