Citizens Bank announced that they have closed $60 million of new senior secured credit facilities for Boston-based footwear company The Rockport Group.

The development follows Berkshire Partners LLC and New Balance‘s joint acquisition of The Rockport Group from Adidas earlier this month. The transaction brought New Balance brands Cobb Hill, Aravon and Dunham into the Rockport portfolio.

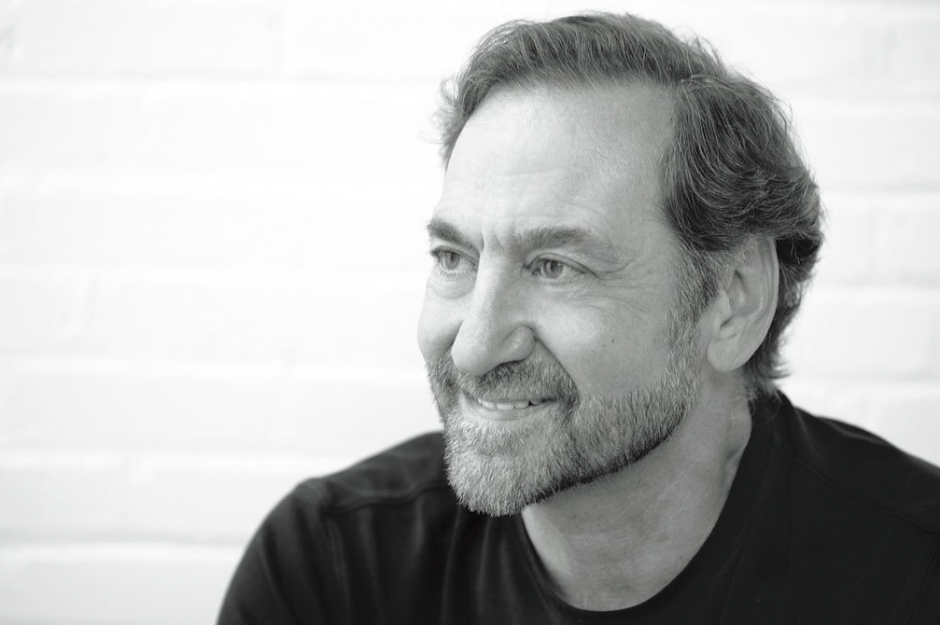

“We are very pleased to have worked with Citizens Bank on this transaction,” says Bob Infantino, president and CEO of The Rockport Group (pictured above). “The deal team at Citizens brought a number of great ideas to the table and executed the new transaction seamlessly. The credit facilities provide significant liquidity and flexibility for The Rockport Group to help facilitate growth as a combined company.”

“The Rockport Group transaction continues our long-term relationship with Citizens Bank,” adds Dave Bordeau, managing director of Berkshire Partners. “Citizens is a valuable financial partner to Berkshire Partners on a number of other portfolio investments and we look forward to working with them more in the future.”