Outdoor Preview: Fall 2015

More Americans are donning outdoor and athletic wear, whether they actually plan to take a hike, break a sweat or not. Looking the part is enough for some and, for many others, donning the spur-of-the-moment versatility that such techy footwear and apparel offers fits their active lifestyle. The key design aspect is crossover appeal. One no longer looks like he or she is heading on a backcountry expedition. Rather, today’s latest styles are all-purpose and can tackle any trail but look just as stylish on a pub crawl.

To wit: Sales of activewear, which includes athletic, sport and exercise apparel, climbed 7 percent to $34 billion in the year ended this past July, according to the NPD Group. And it’s not just stretchy yoga pants that are flying off the shelves as the tracking agency reports that for the 14-week period ended Sept. 20, sales of athletic and outdoor footwear were up 5 percent to $3 billion versus the same period in 2013. Matt Powell, NPD’s sports industry analyst, says the Lululemon-led movement is fueled by consumers ranging in age from 15 to 50 who demand everyday comfort and functionality from their wardrobes. “The consumer is looking for more versatile products that can cross over and do many different things, and that’s had an impact on sales,” he says. Matt Priest, president of the Footwear Distributors and Retailers of America (FDRA), says in today’s society comfort is king and much of that is delivered through wearable technologies. “Consumers may not necessarily be hiking on trails or jogging 10 miles a day, but they want to go about their daily lives wearing comfortable and innovative product,” he says. “They are moving away from cookie-cutter offerings.”

Product versatility is also a sound investment. Greg Stevenson, owner of The Hike House in Sedona, AZ, says shoes with crossover appeal often sell better in the store. “A customer investing $130 wants the shoes to be wearable more than on a hike, especially if they are doing that activity only twice a year,” he says. Stevenson cites the long-running success of Inov-8’s Roclite trail shoe as an example. “It’s phenomenal on the trail but I would say 50 percent or more of our customers probably never even saw the trail.” Similarly, Mark McKnight, e-commerce and marketing manager for Rock/Creek Outfitters based in Chattanooga, TN, reports that the chain expanded its selection of “edgier styles that are not core outdoor products” this past year to meet the growing demand. “I think our customer base is getting wider,” he says. “We’ve got young and old as well as people with very little money and the very wealthy.” What they have in common, he says, is a passion for the outdoors and the lifestyle aesthetic.

Kurt Geller, senior merchandise manager for Timberland, says today’s consumer wants to be ready for anything at a moment’s notice. “The products that provide that value will be of choice,” he notes, adding it represents a seismic shift to how the entire outdoor market is approached. “Over the last 10 years the outdoor industry—across all categories—has seen a shift towards more versatile products that suit our ‘everyday outdoor’ lifestyles as compared with where the outdoor industry started, which was very specific expedition-oriented products,” he says.

Big Business

The performance with style movement shows little signs of slowing down. Analysts at Barclays estimate the U.S. athletic market sales will increase by nearly 50 percent to more than $100 billion at retail by 2020. Even Beyoncé is getting in on the game, teaming up with Topshop to launch a collection of “athletic streetwear” apparel and footwear set to launch in Fall ’15. And early last year, hipster haven Urban Outfitters launched Without Walls, in-store shops featuring its own line of apparel and accessories targeting the outdoor and fitness markets that also includes merchandise from Asics, Saucony, Patagonia and others.

Inside such retail formats you will not find heavy, clunky, stiff, brown or olive hiking boots. Those days are long gone. In its place are lighter, stylish and more versatile footwear suitable for all types of walks—or not. “Consumers are looking for something that’s transitional, and that they can wear year-round. Footwear that can easily move them from work to play,” says Yetzalee Cubero, director of marketing for Jambu, a division of Vida Group. The brand has focused its Fall ’15 collection on fusing fashionable uppers with such technical innovations as Hyper Grip outsoles (made with rubber and micro-glass filaments) and Flex Traction carbide spikes on some styles for increased traction on snow and ice.

“When brands like Valentino and Gucci start making running shoes, you know the category has become a fashion statement,” quips Kristina Owen, footwear commercial associate for Salomon, noting that the company has seen growth this year from “diverted use of fully functional outdoor footwear products.” As such, Salomon is launching a collection of men’s hikers for fall dubbed Evasion, the counterpart to the brand’s popular Ellipse collection of athletic-inspired, lightweight hikers for women. “With the popularity of photo sharing, style is increasingly important to the consumer, but only if functionality remains uncompromised,” she says.

Carl Blakeslee, creative director of Portland Product Werks, licensee for Woolrich Footwear, notes how he often sees city dwellers wearing Sorel boots for sartorial reasons, whether the weather is inclement or not. “Those boots are designed for extreme Arctic conditions and I’ve seen people wearing them on the streets of Portland and New York,” he says, adding, “there’s an appetite right now for the outdoor aesthetic.” It’s a hunger that Sorel is eagerly catering to. “We have continued to evolve our boots to accommodate the activities of our consumers, whether traveling through a city or heading outdoors for the afternoon. We want our boots to be a part of their wardrobe for the entire day,” says Erin Sander, global product director. To that end, the Columbia-owned subsidiary has added its patented OutDry technology membrane (a breathable, waterproof construction) to several boots in its casual men’s Paxson collection, as well as incorporated felt liners and wool insulation in its women’s winter styles.

This lean towards a more go-anywhere outdoor look hasn’t escaped the eye of casual lifestyle companies either. Taos Footwear is combining classic uppers with hiker-influenced bottoms for Fall ’15, replete with the brand’s contour footbed with arch and metatarsal support because, as President Glen Barad says, “Consumers are demanding support and comfort in all categories of footwear today.”

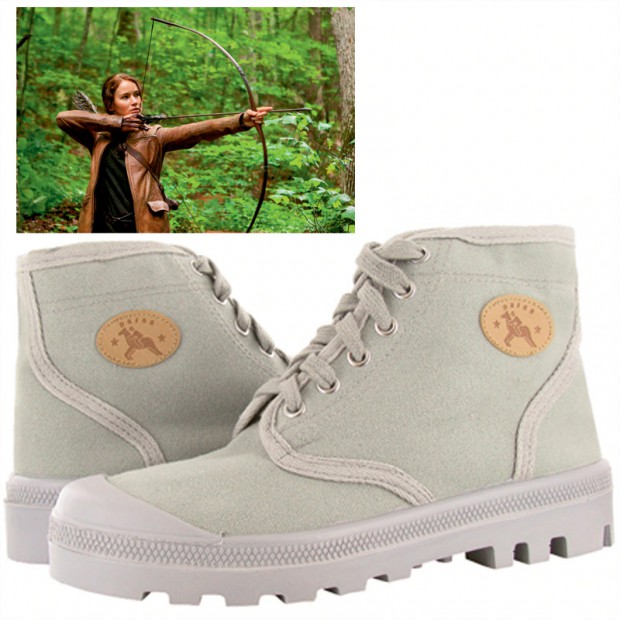

Steve Lax, president of Yaleet, distributor of Naot and Dafna, believes many consumers are taking style cues from outdoor types like Jennifer Lawrence’s character, Katniss Everdeen, the heroine of The Hunger Games franchise. In fact, Dafna’s canvas Scout boot (worn in real life by the Israeli army) is featured in Mockingjay, Part 1. Lax reveals pre-orders for the style, which hits stores next month, have shot through the roof. He’s confident the demand will continue into next fall—when the sequel hits theaters—but also because of its general design aesthetic and comfort. “It’s a retro, military look and we’ve added an anatomical insole to it so it’s much more comfortable than these boots typically are,” he says.

Blakeslee seconds The Hunger Games influence, which was confirmed to him during a recent shopping trip at a Cabela’s location. “The amount of women’s specific camouflage product and bows on the shelves screams Katniss,” he laughs. “But I don’t think this is a flash in the pan. I think it’s a movement.”

It’s not just a women’s movement, either. Ethan Anderson, global vice president of marketing for Sanuk, a division of Deckers Brands, says that the surf staple is looking further inland for Fall ’15 with its Cavalier collection for men. “They are more outdoor-inspired,” he says. “We’re not touting them as the most rugged shoe in the world, but you can take them on the trails.”

The same goes for Ecco, according to Product Director Felix Zahn. The brand is introducing the new Yura collection for men and women next fall. “We’ve taken a true outdoor approach with this low-cut shoe that’s built for the terrain,” he explains, noting that features include a direct-injected outsole, a PU midsole for cushioning and a durable TPU toecap and mudguards. (Some styles feature Gore-Tex waterproof linings.) “The line between casual lifestyle and outdoor lifestyle shoes is so thin right now,” Zahn offers. For example, the consumer is demanding more color and Ecco’s new collection is available in blue, green and red for men and bright—but not neon—colors for women.

The Real Deal

Just because brands are upping their fashion ante doesn’t mean consumers will settle for anything less than legitimate technologies. Even if they never use the products for their intended purposes, they want the comfort knowing they can. “There seems to be an authenticity gauge that consumers are wise to,” notes Blakeslee. Translation: They can spot a poseur brand easily. “Brands that are more rooted in the authentic outdoor lifestyle are really the ones that have the most potential to grow in this climate,” he says.

Todd Lewis, global product director of footwear for Columbia, says consumers armed with smartphones while shopping do the necessary detective work on the spot as to whether a brand is authentic or not. “They expect innovation and versatility,” he notes. “It’s not something that’s an extra anymore.” For Columbia that translates to combining its proprietary Vent construction technology with its patented OutDry to offer 360 degrees of ventilation for breathable temperature regulation in several styles like the Ventrailia OutDry and Ventfreak Mid OutDry. Elsewhere, its Minx collection for women has expanded, which Lewis describes as “jackets for her feet,” featuring Omni-Heat and Omni-Grip technologies. “They are products she wants to wear versus has to wear when the weather turns bad,” he claims. “People love the technology, but they also have to fall in love with the piece. It has to look great.”

Kamik has taken a similar hybrid approach this fall, incorporating Polartec’s Alpha (a lightweight, breathable insulation) and NeoShell (a waterproof, flexible membrane) technologies in winter boots for women. “All of the bulkiness that you would typically find in outdoor footwear products is gone,” reports Annie St-Denis, product manager. “It’s functional, performance product built up on more sleek, feminine lasts that conform to the foot.”

Fashion on top of function is a key element of most footwear categories today, notes Jacqueline Van Dine, co-founder of Ahnu, a division of Deckers Brands. “Consumers seek functionality without having to compromise on aesthetics and trends,” she says. Along those lines, Ahnu will expand its selection of insulated boots (bolstered with 200 grams of Thinsulate) for women this fall, adding faux shearling lining and textured suede and leathers to play up the fashion angle.

It’s all about bridging that gap between performance and lifestyle, says Bryan Owen, brand manager for Astral, whose Aquanaut multi-sport shoe looks like a skate sneaker but features a fine mesh that drains water and filters silt and debris and a sticky G15 rubber for scrambling on wet rocks. “Consumers still want a shoe that performs well on the trail outside but they also want a shoe that’s extremely wearable on a lifestyle level,” he says. For Bogs that translates into adding its Rebound shock-absorbing cushioned footbed in all new styles for fall. It includes the Sidney, a women’s waterproof lace-up boot with trendy tartan accents and the Johnny, a men’s waterproof leather lace-up ankle boot on a lug sole. Kelly Santos, vice president of product, says consumers today expect their shoes to fill multiple purposes, be it the “hardcore gearhead who lives in the mountains or an urbanite who loves the outdoor look.”

Timberland describes its approach to this design premise as “quietly expressed,” according to Geller. “We don’t want our consumers to have to sacrifice being warm, dry or comfortable for looking stylish and appropriate from morning ‘til night,” he notes, citing its Schazzberg collection for men as an example. The shoes feature a Vibram rubber outsole, 400 grams of PrimaLoft insulation and moisture-venting Climapath lining, as well as a Pendleton wool collar lining that Geller describes as a nod to both form and function. Likewise, Vasque is introducing an athletic version of its popular Talus hiking boot for Fall ’15: the Talus Trek. Instead of a PU midsole, the Talus Trek will feature a lighter, sportier EVA midsole. “It’s still a hiking boot—we’re still using a leather base—but color pops lend a more youthful feel,” says Brian Hall, director of product development.

Taking a similar aesthetic cue is Hoka One One, maker of maximal running shoes, which will debut its MTN collection of trail running and trekking product that feature oversized midsoles the brand has become known for. “I hope it changes the mindset of both retailers and consumers who have somehow clung to the mindset that a hiking shoe needs to be stiff,” says President Jim Van Dine. “I’ve worked with numerous well-known footwear biomechanics and none of them subscribe to this outdated theory of a stiff hiking shoe.”