Dear Mark…Your life story is about family and shoes. It starts with grandfather, Pop, a.k.a. Vince Canning. He owns The Peacock Shop, two shoe stores in Indianapolis, until the depression forces him to close in 1933. Ever the audacious man, he pivots to selling shoes on the road until he pays off his debts. Then he semi-retires to sunny Delray Beach, FL, and opens Vince Canning Shoes. His son, Vince, Jr., joins the business in 1957. It expands into a solid, four-store business over the ensuing decades.

Flash forward to 1972, and it’s your first childhood summer in Delray Beach with your aunt, uncle, and grandparents. It’s plenty of beach days and tennis matches, but also lots of hard work in the stores. Your first job is cleaning the ashtrays daily. Over the next five summers, you take on more responsibilities and learn retail’s Golden Rule: treat customers how you want to be treated. Other key sales floor lessons: never judge, show everyone respect, and always act like a gentleman.

Now it’s senior year of college at the University of Texas, where you’re majoring in Finance. You have a sit down with Uncle Vince to talk about your future. He makes you an offer: general manager with a salary of $50,000. It’s very tempting. But it isn’t the path for you—yet. You politely decline, determined to forge your own path and learn the corporate world first. You take a position as an auditor with a local bank for $19,000 a year. You might think this is crazy, but this decision teaches you another great business lesson: money isn’t always the most important consideration. Your experience as an auditor teaches you about accounting and internal controls, both critical skills to operating a successful retail business.

Your next career stop, in 1986, is the executive credit training program at First City Bank. You become a lender and learn invaluable financial skills. As a fresh-faced, 25-year-old, you work with seasoned corporate CFOs from Kroger, Federated Department Stores, NCR, and Proctor & Gamble, among others. It’s intimidating, but you gain confidence in your financial skills. In 1989, you move to Fuji Bank, then the largest financial institution in the world. This is the leveraged buyouts era. You love the excitement and challenges. You manage more than $3 billion in loans, including a single, $1 billion loan. Long hours are the norm, but there’s no complaint when you love your job.

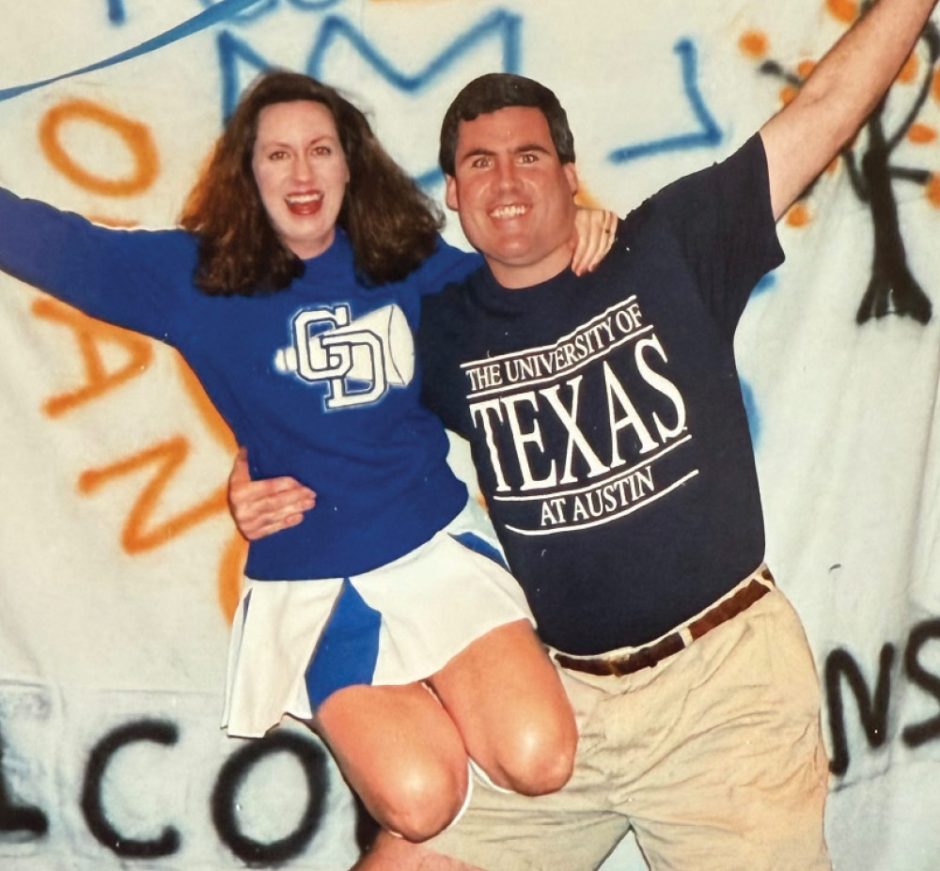

But your family’s rich shoe retailing legacy starts calling. It’s time to return to your roots. Plus, you have a secret weapon: your wife, LaRonda. She’s a top buyer at Foley’s. (She was “buyer of the year” in 1992.) Together, you make a great team.

In 1994, you buy Uncle Vince’s store. The lessons learned in your career immediately come into play. Like the importance of confidence in your abilities. It’s key as you manage salespeople with more shoe experience than you. You’re also reminded that money isn’t the only consideration. You spend that first year or so living off your savings and returning all profits back into the business. This proves important as you have the cash to maintain high credit standards with vendors, and you always pay on time. Side note: cash is king.

One of your first official acts as owner is investing in a computer software system. Unlike your uncle, who claimed he could “look at the wall and tell you anything that’s missing,” you know technology is key to maintaining inventory and retaining customers while increasing profits. Side note: technology is your friend.

Then it’s off to your first WSA Show, where you make one of the smartest business decisions you’ll ever make by attending a NSRA education workshop. By chance, you sit next to Danny Wasserman of Tip Top Shoes. He offers incredible business insights that you’ve never even considered. You also learn a great deal from Maurice Breton of Comfort One Shoes. Many of his brand roster will soon become staples of your merchandise mix. The NSRA community becomes your source for tips and trade secrets. Mentors-turned-friends include Paul Muller, Randy Brown, Jim Sajdak,

Ed Habre, Alan Miklofsky, and Phil Wright. They’re Shoe Dog sages. Side note: always be networking.

After a decade working closely with NSRA, you’re invited to be on its board. In 2010, you become Vice Chair. When you’re asked the following year to become Chair, you’re surprised and humbled. Why a single-store operator and not a multi-store owner? You’re told that it isn’t just about running a successful business. It’s also about leadership qualities. You’re grateful for the opportunity, and even more motivated to make it count.

In 2020, you retire from Vince Canning Shoes and Tootsies (acquired in 2015). A year later, you’re offered another great opportunity: NSRA president. The world is turned upside down by a pandemic. It’s a tumultuous time in independent shoe retailing, and that’s saying something for a channel that has endured wars, recessions, big box retailers, online behemoths, and direct-to-consumer competition. Your retail experience and corporate banking knowledge come in handy. You’re thrilled to assist in any way possible—just like the Shoe Dog sages who helped you along your career journey. You love this industry, and you love giving back.

Take great comfort in knowing that the choices you made throughout your career have been mostly right. (Nobody’s perfect.) You’ve done well! You made the right call by learning from the corporate world before going into small business. You treat others with respect and cultivate strong relationships. You seek out knowledge and implement that wisdom into your business and personal life. You balance hard work with family time. Above all, you follow the path meant for you!