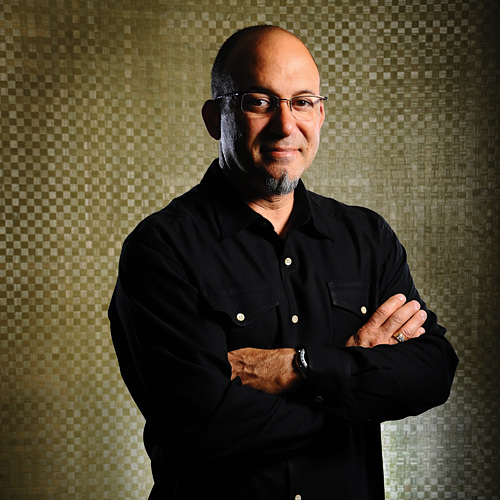

When you are at the helm of one of the fastest growing footwear companies that is spearheaded by the industry’s most in-demand brand (Ugg) for more than a decade running, one might think the lion’s share of attention for Deckers Outdoor CEO Angel Martinez would be focused on that brand. It’d be easy to get caught up in Ugg’s quarter after quarter of record sales growth. It’s the industry darling. The one that never seems to stumble. Ugg is the brand most any executive would like to hang his or her hat on. But what makes Martinez a successful veteran of running footwear companies is his innate ability to see what the potential next big brand will be, which is backed by his proven track record of success with executive stints at Reebok, Rockport and Keen before arriving at Deckers Outdoor six years ago. Sure, Martinez is deeply involved in Ugg as it continues rapid evolution into a full-on lifestyle brand, but he is also focused on the emerging brands in the Deckers portfolio—Tsubo, Ahnu and the recently acquired Sanuk—making sure the brands have the tools and support necessary to make them the next potential Ugg.

“Emerging brands are important in terms of what they do for our ongoing quest for innovation and our ability to bring fresh designs into the market,” Martinez says. “These are unencumbered ideas that are not hindered by the need to do volume right out of the box.” For example, Martinez says if an emerging brand has a sell-in of 5,000 pairs on a new style, that’d be fantastic. In contrast, “If we were to sell 5,000 pairs of something by Ugg, then that’s not so great. And if Nike sold 5,000 pairs of anything, that’d be a disaster—unless it’s shot putting shoes.” Track and field sports aside, Martinez believes emerging brands have long been the lifeblood of the footwear industry. “The energy in our industry has always come from the smaller brands,” he notes. “They are the ones who have historically introduced new concepts that get consumers excited and then the larger brands follow with their version. It creates momentum in the market.” What’s more, Martinez believes emerging brands could be the basis of localized factories in the U.S., where making 2,000 pairs a day could be a profitable enterprise. “The ability to produce innovative new product in a much closer to market sourcing strategy could be more financially feasible for small brands that are stretched anyway for resources,” he offers.

The fact is Martinez is already looking beyond China as the be-all sourcing partner. The writing is on the wall, he believes, and anyone who thinks it isn’t is either clueless or in denial. “Make no mistake about it: This is a revolutionary period in the footwear industry,” he maintains. “The old model of designing product wherever and then making it in China is changing radically.” Ever the entrepreneur, Martinez sees growth opportunities in the oncoming sourcing revolution. They include the creation of new, labor-efficient manufacturing technologies; diversification of sourcing partners that will no longer put the industry at the mercy of one country’s hiccups; and, perhaps most importantly, the possible return of manufacturing jobs to the U.S. “We are going to see production and sourcing in a multitude of countries given China’s increases in labor costs and extension of supply chains with factories moving into the middle of that country. That favors alternative places,” Martinez says, pointing to Latin America, Brazil and Eastern Europe as other possible sourcing destinations. “I think five years from now the landscape for production will look quite different than it does today.”

The sourcing shakeup bodes well for emerging brands. Right now, it’s difficult for such brands to even get on line in Chinese factories. And it’s only getting worse as China’s domestic demand intensifies. “Factories are stretched for space, and the last thing I would do is give up Ugg production for Martinez admits.

A silver lining to this impending sourcing shakeup, Martinez believes, is that the return of manufacturing jobs could help reintroduce the art of craftsmanship in America. “It’s good to make some things with our hands,” Martinez says, adding that not everyone wants to sit at a computer screen or work in a McDonald’s. “It doesn’t matter if it’s a cabinet or a shoe. When it’s genuine, there’s something really special about that whole craft process.” Specifically, footwear manufacturing involves a lot of production and design aspects, not to mention the fact that it has almost universal appeal. “Footwear is a great place to re-build craftsmanship skills,” Martinez says.

In the meantime, Martinez remains focused on making sure all of Deckers’ brands continue to deliver on their respective promises—be it providing the comfort and style of Ugg or Tsubo or battling rapids in a pair of technical Teva watersport shoes to chilling on the beach in Sanuk flip-flops or hitting a local park in stylish trail shoes by Ahnu. The existing portfolio is diverse yet there are performance and style synergies that can be easily passed from one brand to the next. Similarly, Martinez says Deckers’ deepening human talent pool offers opportunities for personal growth within the company as opposed to having to look elsewhere. Deckers has the current make-up of a happy, healthy and growing family, and it is Martinez’s main responsibility to keep it that way. In fact, after 30-plus years toiling away in this business, Martinez has come to an epiphany: “I’ve finally figured out my most important responsibilities, which involve two jobs and neither of them can be delegated,” he says. “First is vision and second is culture. While they are very different, they cannot be separated if you want to run a company successfully.” Martinez says vision involves creating the big picture and planning where Deckers is headed next. “It’s my job to drive that vision: protect it, course correct when necessary, open up paths and celebrate when we can,” he says. The culture aspect is about how Deckers works toward that vision. “It’s my job to create an environment globally in which our vision can thrive,” he says, noting it’s a corporate culture that has been formalized into a mission called the Deckers Way. “It’s a group of tenets that guide how we work and how we work with others. We start with family and end with community.” In between are trust, humility, cooperation and collaboration, accountability, continuous improvement, customer focus, fun, exceptional service, innovation, and celebration. “I have to live these tenets if I expect to uphold our culture, and that’s what I strive to do every day,” Martinez says.

The last time we spoke, you suggested President Obama should be the best one-term president possible so he could do what is right instead of caving in to special interests. Did he follow your wishes?

Not really. I think if he wielded more courage and took forceful action as well as exhibited a willingness to take risks, it would have paid tremendous dividends with American voters. Obama can rattle off the things he’s done, but the frank reality is that most people’s lives are not better off than they were four years ago.

Do you see any viable alternatives?

The system would have to change radically for someone to be able to make an impact. We need someone who could effectively work toward the best interests of all Americans and not just the special interests.

Are you still an optimist despite it all?

Every entrepreneur is an optimist. It’s the nature of the beast. I’m also a pragmatist. I believe that it will eventually change when people get so fed up that there is no alternative but to change. We had a financial debacle, but the people who caused it seem to be better off than they ever were before. The ones who have been affected are the ones who have always suffered: the people in the middle and at the bottom. So until there is a crisis that is so intolerable and really hits everyone, we won’t change.

We may not be better off as a nation, but would you say the footwear industry has recovered somewhat?

Yes. Two things that do well in an economic downturn are footwear and alcohol. Both make you feel good pretty quickly. When you can’t afford the big-screen TV or new car, a new pair of shoes is a great antidote. Even athletic has been on the rebound of late. People often dive into sports during tough economic times as a way to take their mind

off of bigger problems.

In what ways might an emerging brand like Ahnu, Sanuk or Tsubo be important to Deckers in this retail landscape?

Breakthroughs come from emerging brands. I’m hard-pressed to think of a game-changing breakthrough that’s come from an established brand in recent years. Historically, however, our industry hasn’t been great at incubating emerging brands and giving them the time they need to achieve greatness.

Why not?

Unfortunately, larger brands often get stuck in their ways. They don’t become sources for new ideas. It can also be cost prohibitive for smaller brands to get their products made and then marketed to consumers. We’ve got to be careful that the small brands don’t get choked out of the process entirely.

Specifically, what might these brands bring to Deckers?

Our emerging brands can be the difference makers: They bring in fresh ideas and fresh talent, they remind us to focus on what the consumer wants versus what we think they want, and they keep us all from getting stale or believing our own good press too much. We can also take risks and experiment in ways that we can’t always do with more established brands. They can try new designs, materials, manufacturing or marketing ideas. Of course, emerging brands might also deliver immediate incremental sales, new retail accounts and broader distribution. But the real reason behind supporting emerging brands at Deckers is the constant energy they create and the potential for future game-changing products. We’re all essentially one item away from creating a $100 million revenue stream. That is, if we have the patience.

Tell me about the re-launch of Ahnu.

If you step back and look at the marketplace, there’s an intersection of outdoor fitness and metropolitan fashion, particularly among women. Many women don’t want to just go to the gym for their exercise anymore. That notion of going to a sterile fitness club is tired. They want to get outside and breathe real air and walk or run on a real trail. And they want access to those environments the best and quickest they can get to them, whether it’s in San Francisco or Philadelphia. New York’s Central Park is a perfect example and why it’s often filled with joggers and bikers. But what has been lacking for this customer is a sense of style, particularly a lack of color. Ahnu will fill that void from a performance and a style perspective. Certainly, all of the functional benefits needed for a light hike or trail run will be there, because that is just what we do. But Ahnu will also offer a level of style that will appeal to this type of consumer. To put it another way, Ahnu is the polar opposite of Keen. I really like what the brand is doing and the Spring ’12 collection is terrific.

Is it a different customer than Teva?

Definitely. The Teva customer is all about top performance and the product is built the way it is for the function. Ahnu’s product has the necessary functional needs, but this person is not at the base camp to Mt. Everest.

Where is this person going to shop for Ahnu?

At outdoor stores like R.E.I. as well as department stores. One of the things that many outdoor retailers haven’t fully grasped is that they are losing a lot of potential customers because much of the apparel and footwear they carry is not fashionable. If the outdoor industry is going to be really relevant, then they are going to have to be fashion relevant as well. That has simply not been the case in most outdoor stores over the years. I don’t understand why they believe consumers want to buy the same bulky shoes in the same earthy colors year after year. Everybody doesn’t want to buy a Jeep. They may want the functionality of what a Jeep provides, but they don’t all want the same model. They want to drive something that looks different. The same goes for outdoor footwear and apparel.

How big is the potential Ahnu market?

Ask your wife why she doesn’t wear outdoor shoes now. I bet the answer is because they look clunky. They don’t look cute. And who buys 80 percent of the shoes in this country? Women. So how big of a market is it for Ahnu? Well, that seems like it’s pretty big. When the car companies figured out that women were making many of the purchases, they started designing SUVs that women wanted to buy and the sales went through the roof. So I believe the potential market for Ahnu is quite large.

Does Sanuk have similar emerging brand attributes?

Yes. When you think of Sanuk, you can’t help but smile. And that sense of fun is contagious. I’ve always believed you can tell everything about a brand simply by looking at it as an item in a store. You can tell if it’s authentic and whether if the shoe was made with love. It shows up in the product. In contrast, if it is of shoddy quality, consumers are intelligent and can see through that. Sanuk, on the other hand, is very clever and, more than anything, gives off a sense of fun. You get the sense that everybody involved with the brand is having a great time—from [founder and CEO Jeff Kelley] on down to the guys working in the warehouse. The brand is also very accessible. They’ve been good about price points being within reach and the brand continues to evolve in a way that feels inclusive to a broader audience. Sanuk is not about trying too hard or being too cool. It’s the perfect vacation shoe—and will be the ones I’ll be wearing on mine.

Sanuk has been approached for acquisition many times before, so how did the deal come about?

Two ways. About three years ago, [Deckers Outdoor founder] Doug Otto’s brother, Rick, was designing for Sanuk. Doug told me that the brand was doing some pretty interesting stuff. So that’s how it first got on my radar. I then kept an eye on them and saw that they were getting real traction. In particular, they were getting more authentic in the action sports and surf markets. For example, when Sanuk went up against Reef, it performed extremely well. Eventually, we got to talking and learned that Sanuk had made a list of companies if they were going to be acquired, and that Deckers would be their top choice. It was flattering. After we met, the synergy between the two companies was incredible. We sort of see the world the same way. I don’t think we are very ‘corporate,’ even though we are a public company. Like Sanuk, we really have a passion for making footwear—it’s really all we do, for the most part. Sanuk didn’t want to be acquired by a company where footwear would be an afterthought.

Has Sanuk scratched the surface of its full potential yet?

They are about $50 million in annual sales at this point. They have a lot of room to grow and will evolve into more of a year-round business. Our goal is to give Sanuk gasoline to throw onto the fire. That’s what we can do for a brand with potential. We have the resources and distribution to make that happen. And Jeff will continue to be the visionary and creator and his marketing team, which is terrific, remains intact. I should also note that Sanuk has always run as an amazingly tight ship. Those guys like living under the radar and perhaps want people to think they are a bunch of surfer dudes, but the fact is they are anything but that. Overall, it’s a great partnership for both Deckers and Sanuk.

On the other side of the spectrum, has Ugg reached its potential?

We still have plenty of room to grow. While we look at Ugg from a revenue point of view, we also look at the total pairs sold to help us gauge potential. The current 10 million pairs sold isn’t a huge number as compared to some footwear brands and, certainly isn’t all that large taking into account the global opportunities we see for the brand. When you can deliver what the consumer wants, whether it’s an iPod or a pair of Ugg boots, and then innovate to offer the consumer the iPad or Ugg sneaker, you realize there is still plenty of growth. Ugg has done a great job of expanding its story beyond the classic boot, and we’re taking the brand global in a larger way as well. On the product side, you see an expanded men’s business; a women’s line that includes heels, sneakers and flip-flops; new outerwear, apparel and handbag collections; an Italian-made fashion collection; and a broader kids’ business. This fall looks great and it’s the same for Spring ’12. On the distribution side, we’re opening five more stores in China this year, we’re entering Latin America for the first time and we have a few other markets on the schedule for entry.

Speaking of hot brands, what’s your take on the minimalist footwear craze?

We are addressing that category within Teva with our Zilch sandal, the thinnest sandal we have ever made. It’s designed to bend and flex naturally with the foot, giving a great connection to the ground but also giving traction and protection that a bare foot doesn’t. It’s so flexible that it can be rolled up, making it easy to pack for travel.

It seems, when it comes to footwear, less is more these days.

The barefoot phenomenon is interesting, and it has a lot to do with fashion. People just really like the way these shoes look. Some might describe the shoes as wellness, but you could also make a case that they are the opposite of that. There are people who can run in barefoot types of product and there are people that should never do that. I think the biggest beneficiary of the barefoot running trend is going to be the podiatrist and orthopedic surgeons who are already making a killing fixing all the injuries as a result of those who should not be running in those shoes. When you are 22 and all of your ligaments and joints are still flexible and your body has resiliency, you can run barefoot no problem. But for people who grew up walking in heeled shoes of some kind, even if it’s only an inch and a half, to suddenly go running in barefoot product is a very risky decision, in my opinion.

Most people are wearing these shoes as fashion.

True. But the shoes still have to be wearable. I was walking around New York recently when it was 100 degrees and I don’t think you would want to be in barefoot shoes in those conditions. That blacktop is hot. Your feet will burn. Nonetheless, it’s an interesting trend, just like Earth shoes from 40 years ago. Shoes come and go. The benefits may be questionable for some, but if people like it, they like it.

Two years ago everyone was raving about shaping and toning footwear. Might that have jumped the shark already?

Well, you have to look at what was promised. The last time I checked, I didn’t see anybody’s butts getting slimmer or legs getting shapelier by wearing those shoes. And that was the promise. So when you don’t deliver on a promise the consequences may not be that good.

Which is pretty much like every diet ever introduced.

Yes, but people often don’t hold a diet accountable as much as themselves for the failure. It’s why people keep going back to the same diet. But when people buy a product that doesn’t work, they hold the product accountable. In this case, the shoes are being blamed. The concept doesn’t really work and the consumer, for the most part, has discovered that fact. Those that claimed the shoes would tone and flex muscles that normally don’t get much exercise, which is kind of what MBT was saying, was one thing. But Skechers promises that wearing Shape-Ups will result in a body like Kim Kardashian’s. Come on. Kardashian got that body from doing a lot of other stuff as well. There’s nothing on those products that state, ‘Wear these in combination with walking five miles a day and eating right.’ If you say it’s going to happen and it doesn’t, well that’s snake oil. You’ve got to be careful making those types of claims, because it can come back negatively at your brand 10-fold.

In general, are consumers as freaked out compared to a few years ago?

I don’t think consumers are going to freak out any more than they already have. And Americans are not going to give up shopping, which makes them feel better. I think consumers have become resigned to the new reality. And the younger customer, to some extent, is now saying, “I’m never going to buy a house. Look what happened to my friend who did.” So they are going to rent, like many people do in Europe and Japan. That’s OK. Since they are not saving up to purchase a house, it enables them to buy all kinds of other stuff. We are seeing a shifting dynamic among a lot of consumers. What’s going to happen is a split: you either buy great brands or commodity products, and there will be little in-between. For example, if you are a private label brand in a department store, you better be at a commodity price or you don’t have a chance. And there is only room for X number of brands in a store. You can’t have too many brands, otherwise it gets too confusing.

If you could tell retailers one thing, what would it be?

The world is bifurcating into two categories: On the one hand there’s brands and on the other, there’s commodity. Focus on the brands, especially the emerging ones, because that’s where your next retail success story will be found. In addition, retailers will see success when they offer the consumer something that the brands themselves can’t offer, either in a brick-and-mortar or digital setting. Selection and service are the difference-makers for our retail partners and the method they use to create loyalty from their customers. So I would advise retailers to create a relationship with your customer using every means available to you: inside your stores, where you can control selection and service, and your media, where you can illustrate your selection. And also make sure your social media programs allow you and your fans to talk about your selection and service, because brand loyalty is the one thing you can own that a commodity never will.

Is our industry up to speed on the social media revolution?

This social media revolution has a long way to go before we fully grasp what its influence and implications will be. Having said that, once you give that level of power to the consumer, there’s no taking it back. This will be a key part of any marketing equation going forward. We, as an industry, should be looking at ways to work together to understand this new medium. If we collectively figure some things out, we all would benefit. Right now, there’s a lot of clutter. But while the technology might be different and confusing, it all stems from the need for humans to communicate. It goes back to days of communicating by tom-tom drums. Social media is really no different.

What do you love most about your job?

Hands down, the people at Deckers are the best group of people that I’ve worked with in my career. Combining this team with the culture we’ve built here means that every day in the office is a good day, even when it’s a tough or challenging one. Pushing our vision, creating an environment for innovation, focusing on our emerging brands and experimenting—if I can accomplish a bit of that every day, it’s a good day. Vision and culture are my jobs and, in reality, I’m trying hard to become the dumbest guy in the room. When I reach that point, then I guess I’ll know my work here is done. —Greg Dutter